|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

|

|

|

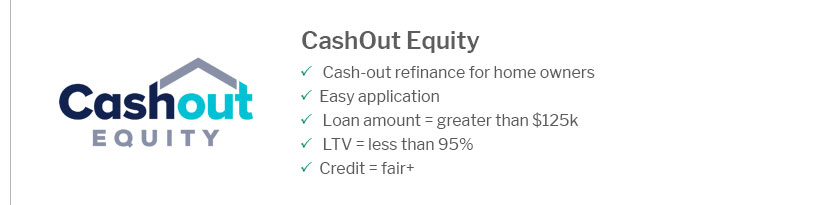

Best Refinance Companies: Key Features and HighlightsRefinancing your mortgage can be a strategic move to lower your monthly payments or reduce the total interest paid over the life of the loan. Choosing the right refinance company is crucial for achieving the best terms and rates. In this article, we will explore some of the top refinance companies, examining their key features and what sets them apart. Understanding Refinancing BenefitsRefinancing can offer several advantages, including reduced interest rates, shorter loan terms, or switching from an adjustable-rate to a fixed-rate mortgage. It's important to evaluate your financial goals before deciding to refinance.

Top Refinance Companies to ConsiderQuicken LoansQuicken Loans, known for its Rocket Mortgage platform, offers a streamlined online process and a variety of loan options. It's renowned for customer service and competitive rates. Better.comBetter.com eliminates many traditional fees, such as origination fees, and offers a straightforward digital experience, making it an attractive option for tech-savvy borrowers. LoanDepotLoanDepot provides a mix of digital convenience with personal service through a network of loan officers. They offer a range of products, including options for those considering a 30 year jumbo mortgage. Key Considerations When Choosing a Refinance CompanyWhen selecting a refinance company, consider these factors:

Also, explore options for easy mortgage loans if you need a simple and hassle-free application process. FAQs About RefinancingWhat is the best time to refinance a mortgage?The best time to refinance is when interest rates are lower than your current mortgage rate, and you plan to stay in your home long enough to recoup any closing costs associated with refinancing. How does refinancing affect my credit score?Refinancing can have a minor impact on your credit score due to the credit inquiry and opening a new loan account. However, timely payments on the new loan can help improve your credit over time. Can I refinance if I have bad credit?Yes, it is possible to refinance with bad credit, but it might come with higher interest rates. Working with a lender that specializes in bad credit refinancing can be beneficial. In conclusion, selecting the right refinance company involves considering rates, fees, and service quality. By doing your research and understanding the benefits of refinancing, you can make an informed decision that aligns with your financial goals. https://www.cnbc.com/select/the-best-time-to-refinance-student-loans/

How to choose the best lender to refinance with - Best overall: SoFi Student Loan Refinancing - Best for fair credit score: Earnest Student Loan Refinancing - Best ... https://mfmbankers.com/loan-products/refinance/

We're one of my best home mortgage refinance companies in NY offer special refinance programs which can facilitate you with many benefits. Contact now. https://www.savingforcollege.com/best-student-loan-refinance-companies

While Savingforcollege.com strives to keep the information up to date, the lender rates, terms and other information are subject to change at ...

|

|---|